Acrux Compliance Risk Management System

Financial institutions are reeling under the pressure of an increasingly complex and costly regulatory environment. Our Compliance Risk Management System (CRMS) combines technology and domain knowledge to help banks and Financial Institutions effectively achieve regulatory compliance while cutting costs. The Compliance function is now expected to provide practical solutions on how regulations translate into specific actionable items, assessing compliance specific risks and bringing transparency in residual risk process. Acrux CRMS streamlines compliance processes with standardized workflows, comprising of the following modules:

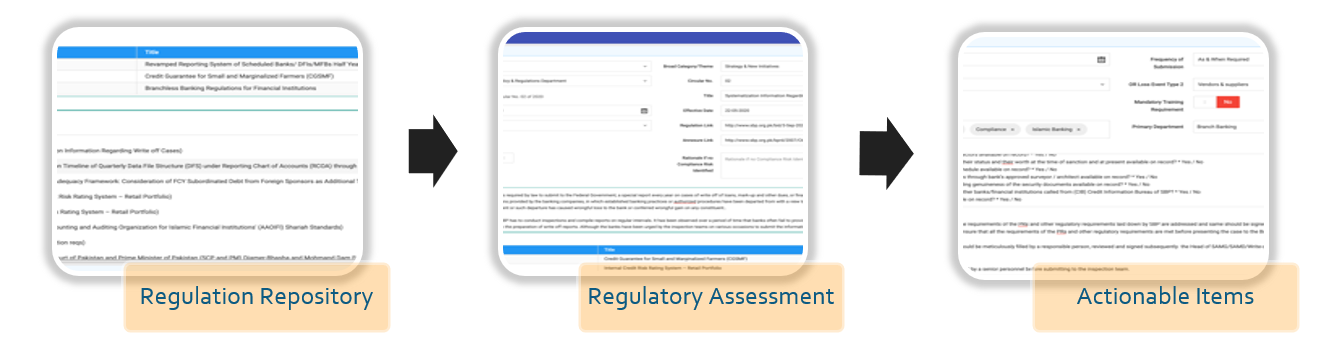

Regulatory Assessment

Regulatory Assessment module captures, assesses and translates the new regulations into specific operational requirements and forward it to the respective stakeholders. These regulations and action items are managed by dashboards. It also maintains up-to-date regulatory repository for all the applicable laws, rules, regulations and instructions which can be search by powerful and easy to use search engine.

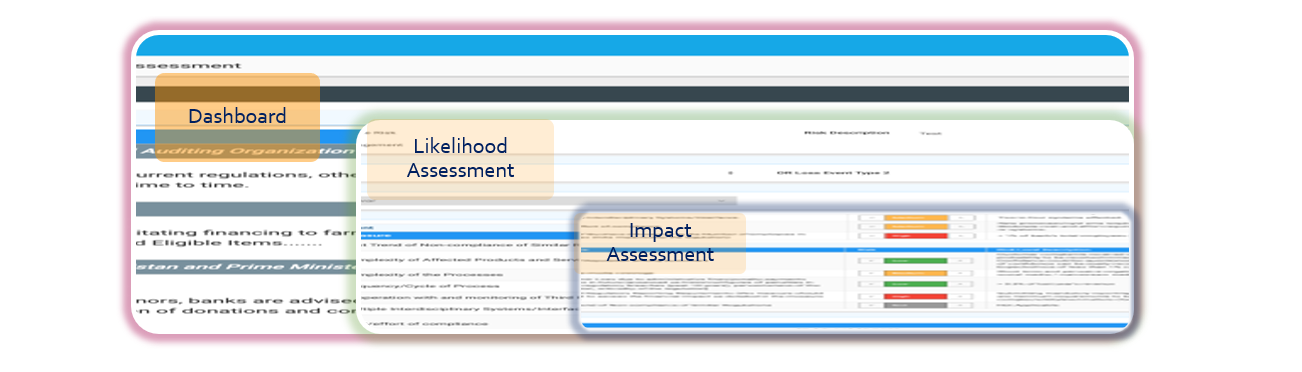

Inherent Risk Assessment

Our adopted best practices for compliance management ensures that compliance risk is adequately managed. For this, our CRMS provides the methodology for assessment of inherent risks and the assignment of risk ratings that best describe the level of compliance risk for each applicable regulatory requirement.

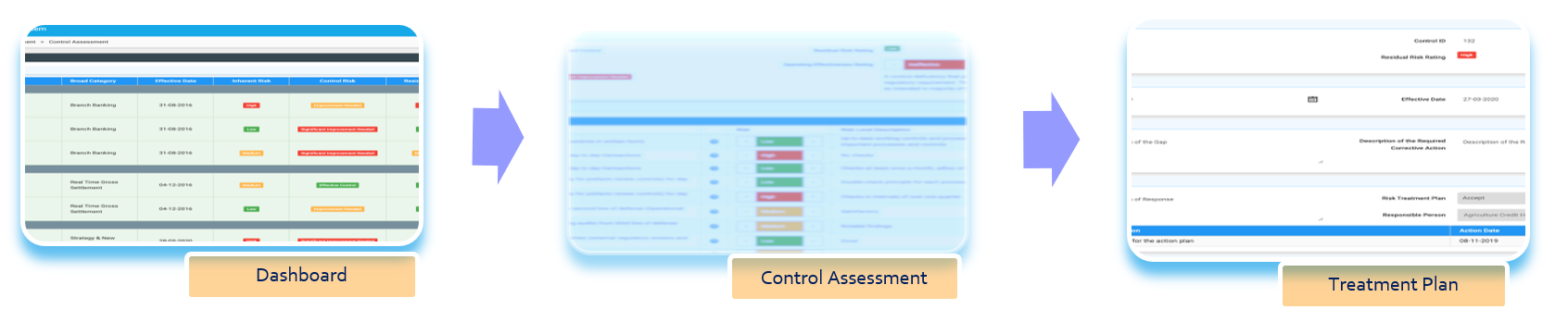

Control and Gap Assessment & Treatment Plan

Once Inherent Risk is identified for the regulatory requirements, our CRMS facilitates the business users to introduce the adequate controls and mitigate the compliance risk. CRMS also maintains the controls inventory which has the flexibility to add new controls.

These modules are key to calculating the level of residual risks and also recommend the corrective plan to reduce unacceptable residual risks to an acceptable level.

Other functionalities for Compliance Risk Monitoring, KRI metrics and reporting are also available in the CRMS.

Acrux CRMS – Business Case and Functionality

- Fully integrated system for end-to-end compliance workflow as per SBP and PBA requirements

- Centralized system to capture all compliance related requirements, including:

-

- New regulations

- SBP inspection observations

- Internal audit observations

- External audit observations

- Automated Compliance task management

- Web-based application accessible to all authorized users from any location

- Increased transparency of compliance implementation

- Compliance reporting calendar available within the application

- Reduced risk of SBP fines and reputation damage

- Provides precise picture of all compliance activities and raises flag in case of delays

- Central management of all compliance activities from a single screen with real-time risk status

- Role-based access control to provide enhanced security

- Complete audit trail of all activity

- Electronic archive of all regulations and controls

- Increased compliance awareness supporting the establishment of compliance culture

- Automated reminders and emails regarding required compliance actions

- Ability to integrate with the existing technology of the client

- Powerful and easy to use search engine to search historical data

- Strong data analytical capabilities through our data analytics tool – Acrux Insights

Our Key Differentiators

- Competitive Pricing (Graduated according to size of business and starting at low price thresholds)

- Flexible delivery and deployment model (Rental/SaaS model, with multiple hosting options)

- Ready to go

- Pay and Retain only if you are satisfied (better than money back guarantee, first payment after three months of satisfactory operation)