As per State Bank of Pakistan regulation, BPRD Circular Letter No. 19 of 2018, a Compliance Risk Management (CRM) System is a requirement for all Banks/DFIs operating in Pakistan.

Acrux Technologies has developed CRM system based on SBP Risk Management Guidelines and Pakistan Banks’ Association published Business and Functional requirements.

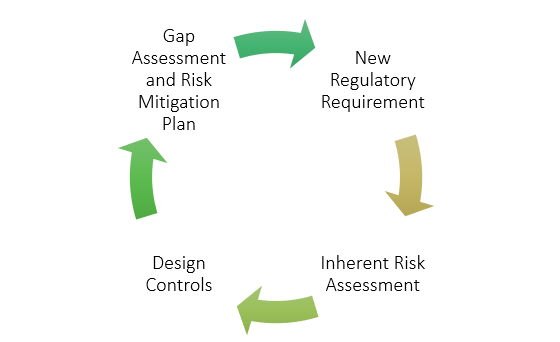

New Regulation Assessment

Our CRM offers the following features:

- Fully integrated system catering complete compliance workflow

- Centralized system to capture all compliance related requirements, including:

- Automated Compliance task management

- Web-based application accessible to all authorized users from any location

- Increasing transparency of compliance implementation

- Compliance Reporting Calendar available within the application

- CRM system reduces the risk of SBP fines and reputation damage

- System provides precise picture of all compliance activities and raises flag in case of delays

- Central management of all compliance activities from a single screen with real-time risk status

- Role-based Access Control to provide enhanced security

- Complete Audit Trail of all activity.

- Electronic Archive of all regulations and controls

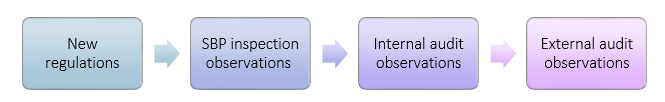

Compliance Risk Monitoring