Conversational Income Tax e-filing Solution

Acrux Technologies has leveraged its expertise of taxation systems and developed a state-of-the-art Income Tax e-filing system called, TaxMuawin, which is similar to such systems in use in United States, United Kingdom, India and elsewhere where the idea of “conversational e-filing” of Tax Return has been firmly established as a best practice and countries are achieving over 90 per cent return filing compliance in this manner, while maintaining very high quality of data and greatly facilitating the taxpayers.

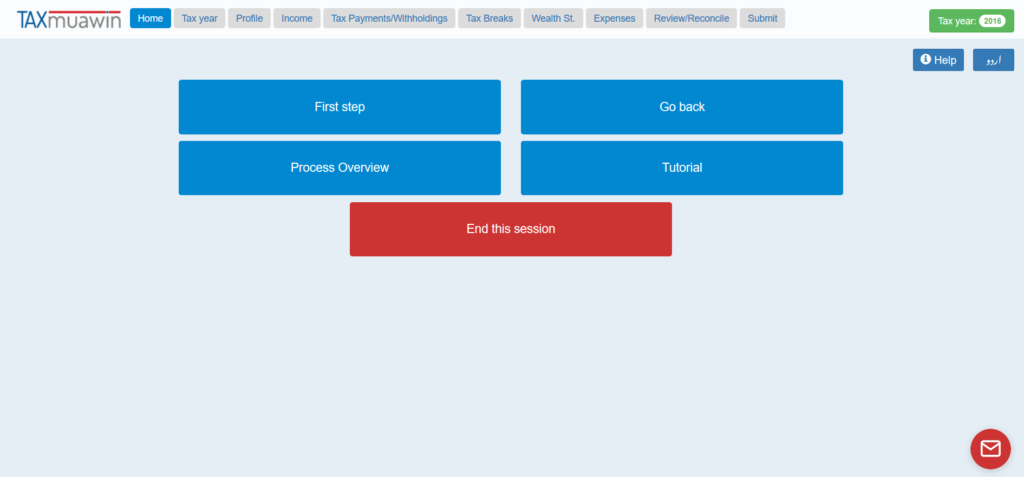

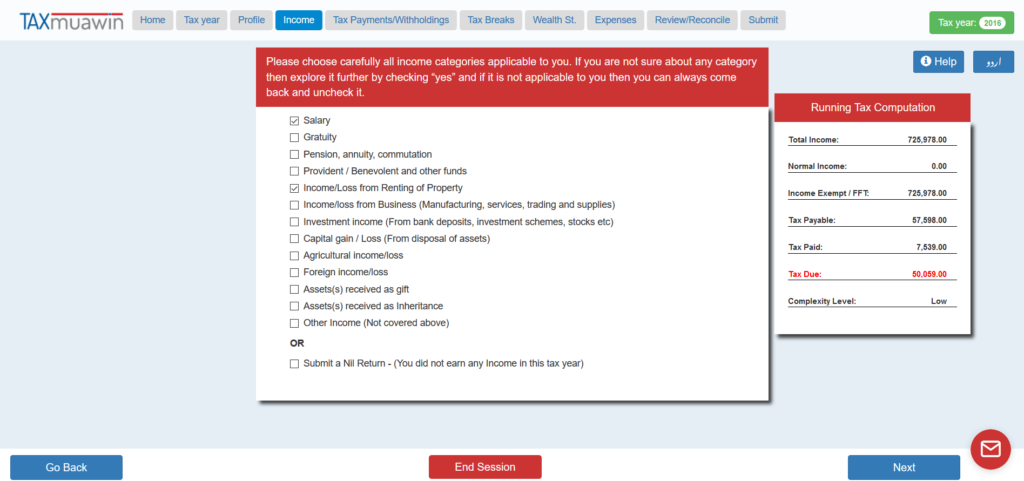

Taxmuawin is a user friendly and conversational e-filing portal which asks step-by-step questionnaire like a tax consultant asking questions, instead of just filling the forms, you are asked only the questions which pertain to you. This process reduces confusion to the user, providing the ability to easily complete their tax return while making the process, from start to finish, quick and easy.

Each step also provides resources/help to answer common questions users may have pertaining to the current topic they are working on. This makes filing extremely easy as well as extremely fast.

Taxmuawin Features

- E-Filing (Fastest way to calculate tax and tax refund)

- Easy Registration

- No tax experience needed

- Conversational Wizard (Step-by-step questionnaire like a tax consultant asking questions, instead of just filling the forms, you are asked only the questions which pertain to you)

- Bi-lingual help/support on each step (English and Urdu) , FAQs and general help which also improve taxpayer education in Pakistan

- Easy to use Interface

- Import information from previous year return for quick filing.

- Simple salaried persons can file tax return in 5 – 10 minutes.

- Separate Category for Business Individuals and AOP (Association of Persons)

- Help user to determine if he qualifies for any tax credit or deduction applicable to him.

- Security (Information is protected with all the current technology and procedures used by banks today.)

- Scalable (Modern technology to scale the application at peak times)

- It will reduce e-filing load on FBR current system and expand e-filing coverage which will increase the number of filers and “tax with return”.